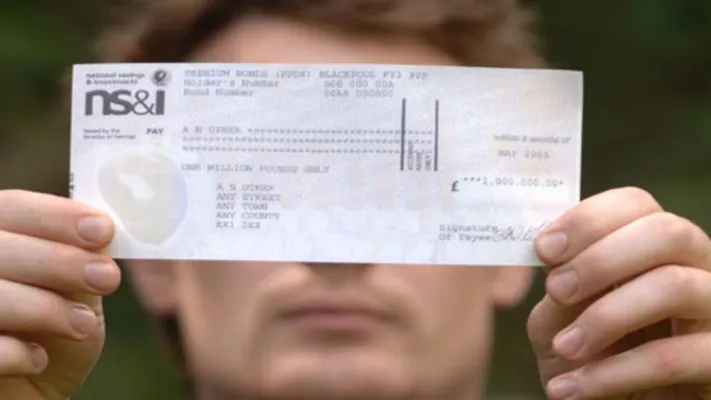

Premium Bonds are a unique savings product offered by the UK government through National Savings and Investments (NS&I). Instead of earning interest, bondholders are entered into monthly prize draws for tax-free cash prizes ranging from £25 to £1 million. This guide provides a comprehensive overview of how to set up a Premium Bonds account, manage it, and understand the associated benefits and considerations.

Understanding Premium Bonds

Premium Bonds are a form of investment where each £1 bond has an equal chance of winning in a monthly prize draw. The minimum investment is £25, and the maximum holding limit is £50,000 per individual. Unlike traditional savings accounts, there is no guaranteed return, but the allure lies in the potential for substantial tax-free prizes.

Eligibility Criteria

To purchase Premium Bonds, you must:

- Be at least 16 years old to buy for yourself.

- Be a parent or guardian to purchase for a child under 16.

- Have a UK bank or building society account in your name.

It’s important to note that while UK residents can easily purchase Premium Bonds, non-residents may face restrictions and should consult NS&I for specific guidance.

Steps to Set Up a Premium Bonds Account

1. Choose Your Application Method

There are three primary ways to apply for Premium Bonds:

- Online: Visit the NS&I Premium Bonds page and follow the application process.

- By Phone: Call NS&I at 08085 007 007 to apply over the phone.

- By Post: Download and complete the application form and send it to NS&I, Sunderland, SR43 2SB.

2. Provide Necessary Information

Regardless of the application method, you’ll need to provide:

- Full name, address, and date of birth.

- National Insurance number (if applicable).

- UK bank or building society account details for prize payments and withdrawals.

3. Make Your Initial Investment

The minimum initial investment is £25. You can fund your account using:

- Debit Card: Accepted for online and phone applications.

- Bank Transfer or Standing Order: Use your holder’s number as the reference. For Premium Bonds, the NS&I bank details are.

Ensure each deposit is at least £25 and in whole pounds.

4. Register for Online and Phone Services

To manage your account online or via phone, you’ll need to register:

- Complete the online registration form.

- Provide proof of identity, which may require a witness to confirm your signature.

- Once registered, you’ll receive an NS&I number and can set up a password for secure access.

Managing Your Premium Bonds Account

Online Account Management

After registration, you can:

- Check your bond holdings and prize winnings.

- Update personal details and bank information.

- Reinvest prizes or withdraw funds.

Prize Draws and Winnings

Each £1 bond number is entered into a monthly prize draw. Prizes range from £25 to £1 million, and all winnings are tax-free. The odds of winning any prize per £1 bond are currently 24,000 to 1. Prizes can be:

- Paid directly into your nominated bank account.

- Reinvested into more Premium Bonds (if under the £50,000 limit).

Checking for Prizes

You can check if you’ve won by:

- Logging into your NS&I online account.

- Using the official NS&I prize checker app.

- Calling NS&I’s automated phone service.

Gifting Premium Bonds

Premium Bonds can be a thoughtful gift for children under 16. To gift bonds:

- Complete the application form for gifting.

- Provide the child’s details and your information as the nominated parent or guardian.

- Send the form by post to NS&I.

The child will take ownership of the bonds upon turning 16.

Considerations Before Investing

While Premium Bonds offer the excitement of potential prizes, it’s essential to consider:

- No Guaranteed Returns: Unlike traditional savings accounts, there’s no guaranteed interest.

- Inflation Impact: The value of your investment may erode over time due to inflation.

- Prize Odds: Smaller investments have lower chances of winning significant prizes.

For those new to investing, exploring other options like Investing in Stocks Market or resources tailored for Stocks Market For Beginners can provide diversified investment strategies.

Conclusion

Setting up a Premium Bonds account is a straightforward process that offers a unique blend of saving and the thrill of potential winnings. While they may not suit every investor, especially those seeking guaranteed returns, they can be an exciting addition to a diversified savings portfolio. Always assess your financial goals and consider consulting with a financial advisor to determine the best investment strategy for your needs.

Related topics: