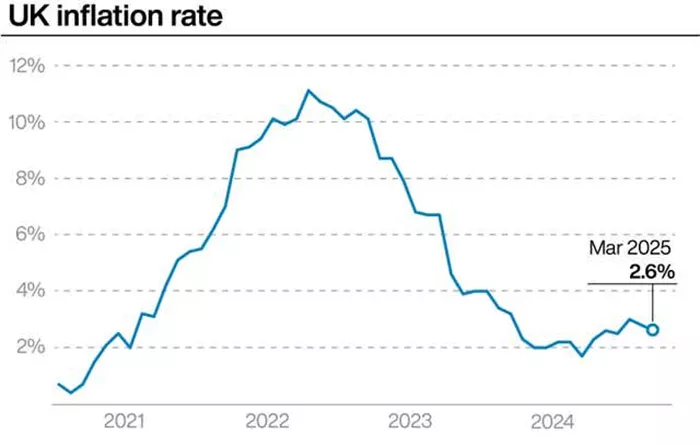

The United Kingdom experienced a sharper-than-expected rise in inflation in April, reaching 3.5%, up from 2.6% in March. This marks the highest inflation rate since January 2024 and the largest monthly increase since 2022, when inflation was above 10%.

A significant factor behind this jump was a 27.5% surge in airfares during the Easter holiday, which fell in April this year. This contributed heavily to the sharp increase in consumer prices. Other major contributors included rising costs in housing, household services, transport, and recreation.

Economists had forecasted a 3.3% inflation rate for April, and the Bank of England had predicted 3.4%, so the actual figure exceeded expectations. The monthly increase in consumer prices was 1.2%, the largest since April 2024.

Finance Minister Rachel Reeves expressed disappointment over the inflation data, noting that it reduces the likelihood of interest rate cuts in the near future. She emphasized the government’s commitment to improving household finances despite inflation pressures.

Following the data release, the British pound strengthened slightly against the US dollar. Market expectations for an interest rate cut in August dropped from 60% to 40%, reflecting concerns that the Bank of England may slow its pace of easing monetary policy.

Core inflation, which excludes volatile items like energy and food, also rose to 3.8% annually in April, up from 3.4% in March. Services price inflation—a key indicator of domestic inflation pressures—jumped to 5.4% year-on-year, surpassing forecasts and marking the largest monthly rise in 34 years.

The Bank of England recently cut interest rates to 4.25% but remains divided on the path forward. Some officials worry that inflationary pressures, especially from wages, remain strong. The Bank predicts inflation could reach 3.7% by September before easing back to its 2% target.

A survey also suggests employers may begin to slow wage increases, which could ease inflation pressures over time. However, the recent inflation spike complicates the Bank’s decision-making on future rate cuts.

In summary, the unexpected rise in UK inflation in April has raised concerns about the economic outlook and the timing of interest rate cuts. Policymakers face a challenging balance between supporting growth and controlling inflation.

Read More: