SiCarrier, a Chinese chip equipment startup with strong ties to Huawei, is seeking to raise $2.8 billion in its first fundraising round, according to two sources familiar with the plans. The company aims to expand its customer base and establish a stronger presence in the semiconductor industry.

Founded in 2021 and owned by the Shenzhen government, SiCarrier was relatively unknown until recently. This year, it has gained attention within China’s semiconductor circles due to its ambitious goals and product range. SiCarrier is aiming to become the leading domestic provider of chipmaking equipment, challenging current market leaders Naura and Advanced Micro-Fabrication Equipment China (AMEC), according to four people with knowledge of its ambitions.

The company’s rise is seen as a direct response to U.S. export restrictions on chipmaking equipment and advanced semiconductors to China. These restrictions, while limiting China’s access to foreign technology, have driven Chinese companies to strive for greater self-sufficiency in the chip sector, in line with President Xi Jinping’s vision.

The Shenzhen government plans to sell around 25% of a SiCarrier subsidiary, targeting a valuation of 80 billion yuan ($11 billion). The fundraising is expected to conclude in the coming weeks, with funds primarily earmarked for research and development. Chinese state-owned enterprises, state funds, and domestic venture capital firms have shown interest in participating, according to two sources. If successful, it could be one of the largest yuan-denominated fundraisings in China this year.

SiCarrier, which was added to a U.S. export control list last year due to its ties to Huawei, did not respond to requests for comment. Huawei has denied any affiliation with SiCarrier, and the Shenzhen government also declined to comment.

A New Player in the Semiconductor Market

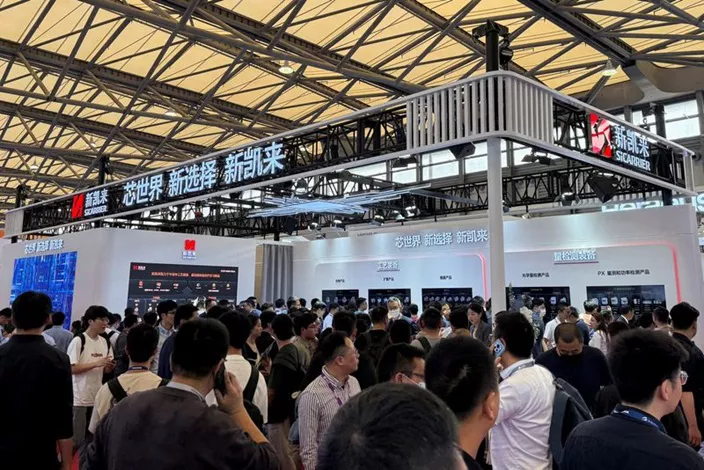

SiCarrier made its public debut at the Semicon China trade fair in March, showcasing a catalog of 30 machines, including etching tools and inspection equipment, named after Chinese mountains. However, its lithography systems were not on display. While the company has not disclosed the readiness of its products, sources indicate that most of SiCarrier’s equipment is still under development and not yet ready for mass production.

Experts have raised doubts about the company’s ability to rapidly develop and validate such complex machinery. Bernstein analysts noted in a March report that, considering the short time since its founding, it seems unlikely SiCarrier could have completed the extensive verification processes necessary for its products.

Despite these challenges, SiCarrier’s ambitious plans are seen as part of a larger effort to reduce China’s reliance on foreign-made chip equipment. In 2023, domestically made wafer fabrication equipment accounted for just 11.3% of China’s total purchases, with the country spending $128 billion on such equipment since 2020, according to data from consultancy TechInsights.

Ambitious Product Lineup

SiCarrier has filed 92 patents for semiconductor equipment between October 2022 and March 2025, aiming to provide a comprehensive range of tools for chip production. Its patents cover a wide range of products, including wafer measurement devices, etching systems, and deposition systems. These efforts put SiCarrier in competition with global players like KLA, Lam Research, and Tokyo Electron.

The company is also investing in AI-driven technology for wafer defect recognition, which could improve chip yield rates. In particular, its measurement and inspection tools are seen as areas where SiCarrier could make a significant impact in China, as there is no dominant local player in these fields.

SiCarrier is also exploring multi-patterning chip-making techniques and deep ultraviolet (DUV) lithography systems, which it believes could address China’s lack of access to extreme ultraviolet (EUV) lithography tools. However, the multi-patterning approach has its critics, who argue that it is prone to errors and lower yields due to the increased complexity of the process.

Concerns Over Huawei Ties

SiCarrier’s strong connections to Huawei have raised concerns among potential customers. Some Chinese foundries have been hesitant to adopt SiCarrier’s equipment, fearing that it could lead to the leakage of trade secrets to Huawei. Industry executives have noted that SiCarrier’s close ties to Huawei, including the secondment of staff from Huawei’s HiSilicon chip design unit, have raised alarms about confidentiality risks.

Despite these concerns, some Chinese companies have supported SiCarrier’s efforts, viewing it as a government-backed initiative to reduce dependence on foreign chipmakers. However, as one source noted, SiCarrier must fully distance itself from Huawei to gain broader customer acceptance and ensure the long-term success of its products.

The Road Ahead

While SiCarrier has made significant strides in its early years, it faces a tough road ahead. The company’s equipment is still in development, and it will likely take several years before it can challenge the dominance of established global players in the chipmaking equipment market. Nonetheless, its ambitious goals and substantial backing from the Shenzhen government make it a company to watch as China seeks to strengthen its position in the global semiconductor industry.

Related topics: