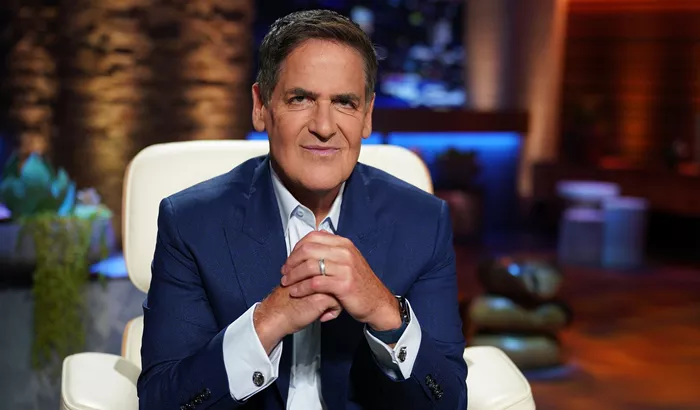

Mark Cuban, former owner of the Dallas Mavericks, is joining a new $750 million sports investment fund as a general partner. The fund, called Harbinger Sports Partners, will buy minority stakes in professional teams across major leagues like the NBA, MLB, and NFL.

The fund aims to raise $750 million by 2027 and is led by experienced sports investors Rashaun Williams and Steve Cannon. Williams has ties to the Atlanta Falcons, while Cannon helped manage the Falcons and Atlanta United soccer team.

Harbinger plans to stand out by using deep knowledge of sports operations and strong connections with league offices and team owners. Williams said the fund focuses on the internal workings of teams to grow their value, especially as sports shift from relying on ticket sales to media and new local revenue sources.

Each league has different rules about ownership. For example, the NFL allows one fund to own up to six teams, while the NBA limits ownership stakes to 20% in up to five teams. MLB allows investments in many teams but limits stakes to 15%.

The fund will focus on established leagues and avoid newer sports leagues. It plans to buy minority stakes of up to 5% in about 15 teams, with investments ranging from $50 million to $150 million.

With Cannon’s experience in stadium building, including Atlanta’s Mercedes-Benz Stadium, the fund is ready to support team growth. The launch comes as leagues like the NFL recently changed rules to allow more private equity investments, capped at 10%.

This new fund shows growing interest in sports as a business and offers team owners new ways to manage their investments.

Related Topics: