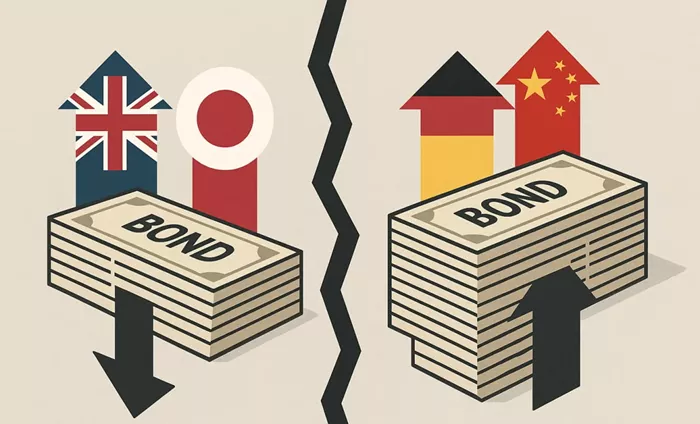

Japanese investors sold a record amount of German government bonds in April, marking the largest selloff in a decade. According to Japan’s Ministry of Finance, net sales reached ¥1.48 trillion ($10.2 billion), the highest since 2014.

This was also the biggest reduction among 12 sovereign bond markets tracked by the ministry, which include debt issued by governments and their agencies.

The selloff came after Germany announced plans to unlock hundreds of billions of euros for defense and infrastructure spending. This fiscal shift caused German 10-year bond yields to jump about 30 basis points in March, followed by a similar drop in April.

The sharp rise in yields initially trapped many Japanese investors in German bonds, but as yields started to fall, they began reducing their exposure, anticipating continued fiscal policy changes in Germany.

Hideo Shimomura, senior portfolio manager at Fivestar Asset Management in Tokyo, explained that the sudden yield spike in early March prevented some investors from selling earlier. Once yields declined, they moved to cut their holdings, reflecting concerns over Germany’s fiscal outlook.

This trend highlights how international investors are reacting to Germany’s new fiscal policies and the resulting volatility in its sovereign debt market.