Nvidia’s stock has surged dramatically, rising about 870% since early 2023, pushing its market value to around $3.5 trillion. The company’s graphics processing units (GPUs), essential for powering artificial intelligence (AI) development in data centers, remain in high demand, outstripping supply.

CEO Jensen Huang highlights that new AI reasoning models require up to 1,000 times more computing power than previous models, fueling expectations that data center spending could reach $1 trillion annually by 2028.

Nvidia’s latest GPU architectures, including the Blackwell series, deliver performance leaps far beyond previous models. For example, the GB200 GPU offers up to 40 times the performance of the earlier H100 chip in specific AI inference tasks, which analyze data to generate user responses.

This boost is crucial as newer AI models like OpenAI’s GPT-4 and Meta’s Llama 4 demand far greater computing resources to refine their outputs accurately.

Looking ahead, Nvidia plans to release GPUs based on the Rubin architecture in 2026, potentially tripling performance again. This ongoing innovation supports CEO Huang’s forecast of massive growth in AI infrastructure spending.

Wall Street analysts predict Nvidia could reach $200 billion in revenue by fiscal 2026, with nearly 90% coming from data center sales, underscoring the company’s dominance in AI hardware.

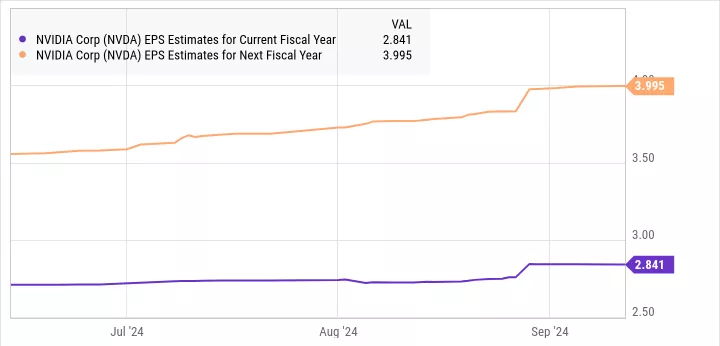

Currently trading near $142, Nvidia’s stock price-to-earnings ratio suggests it may be undervalued compared to its 10-year average.

To maintain its current valuation, the stock would need to rise about 38% in the next nine months, and to align with historical averages, it might climb as much as 79%, potentially pushing the price between $196 and $254 by early 2026. Given these factors and the company’s strong market position, Nvidia is expected to surpass the $200 mark before the end of 2025.

Investors should keep a long-term perspective, as Nvidia’s leadership in AI chip technology positions it well for substantial growth if data center AI spending hits the projected $1 trillion by 2028.

YOU MAY ALSO LIKE: