Asian stock markets gained on Monday, while oil prices continued to rise due to growing concerns that the conflict between Israel and Iran could disrupt global crude supplies.

U.S. crude oil prices increased by 71 cents to $73.69 per barrel, and Brent crude rose 58 cents to $74.81 per barrel.

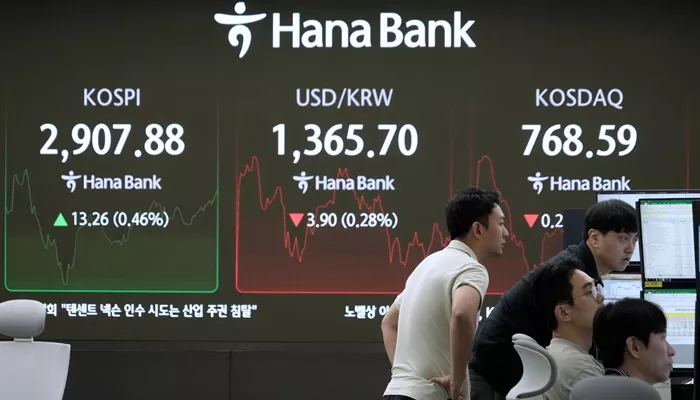

In Asia, Tokyo’s Nikkei 225 index rose 1.3% to 38,311.33, and Seoul’s Kospi gained 1.8% to 2,946.66. Chinese markets advanced after May data showed a 6.1% increase in retail sales year-on-year, despite slower industrial output growth of 5.8%. Hong Kong’s Hang Seng climbed 0.8% to 24,080.61, and the Shanghai Composite added 0.3% to 3,388.73. Australia’s S&P/ASX 200 remained mostly flat at 8,548.40.

Last Friday, oil prices surged more than 7% following Israel’s strikes on Iranian nuclear and military sites, while U.S. stock indexes fell sharply. The S&P 500 dropped 1.1%, the Dow Jones Industrial Average fell 1.8%, and the Nasdaq declined 1.3%.

Iran is a major oil producer, but Western sanctions have limited its exports. If the conflict escalates into a broader war, it could slow Iran’s oil shipments, pushing global crude and gasoline prices higher.

Analysts also worry about potential disruptions in the Strait of Hormuz, a narrow waterway near Iran through which much of the world’s oil is transported by ship.

Companies heavily reliant on fuel and travel demand suffered losses. Carnival cruise line shares fell 4.9%, United Airlines dropped 4.4%, and Norwegian Cruise Line declined 5%.

Conversely, U.S. oil producers benefited from higher crude prices. Exxon Mobil shares rose 2.2%, and ConocoPhillips gained 2.4%. Defense contractors such as Lockheed Martin, Northrop Grumman, and RTX also saw gains above 3%.

Gold prices rose 1.4% on Friday as investors sought safer assets and remained steady Monday. Treasury bond prices fell Friday, causing yields to rise amid inflation concerns linked to higher oil prices and President Trump’s tariffs.

A better-than-expected U.S. consumer sentiment report on Friday contributed to higher Treasury yields. The University of Michigan’s preliminary data showed improved sentiment after tariff pauses, with eased inflation expectations.

In currency markets Monday, the U.S. dollar strengthened to 144.34 Japanese yen from 144.03, while the euro rose to $1.1582 from $1.1533.

You may also like: