The U.S. housing market is stuck in a sluggish state despite it being the peak homebuying season. In April, housing contract activity dropped sharply even though there were more homes available. Buyers and sellers are at an impasse: more sellers are listing homes, but prices remain high, and buyers are cautious.

Mortgage rates have stayed steady between 6.8% and 7% this year. While stable rates help buyers plan, these high rates keep many potential buyers out of the market. Many find renting a larger home more affordable than buying one.

Hannah Jones, senior economic research analyst at Realtor.com, described the current market as having a “failure to launch” feeling due to persistent high prices, high mortgage rates, and growing economic uncertainty.

Lower mortgage rates would likely revive the market, but experts see little chance of rates dropping back to the 3% or 4% levels seen before 2022 unless a deep recession occurs. However, recessions bring their own problems, such as higher unemployment and more mortgage delinquencies.

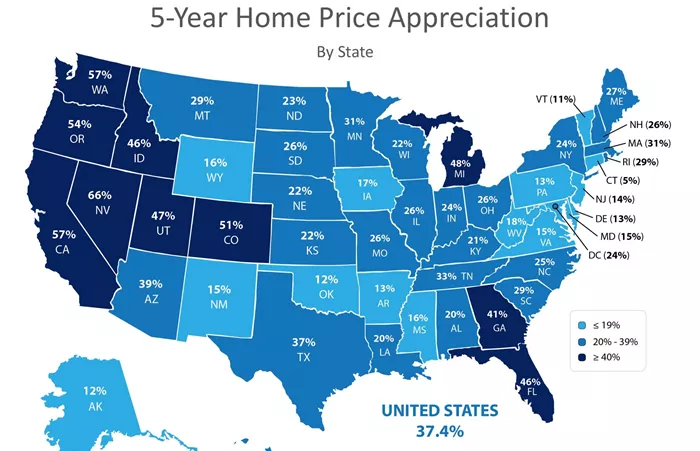

Home prices have grown much faster than wages over the past 25 years. From 2020 to 2022, prices surged due to pandemic-driven demand and historically low rates, while median incomes less than doubled in the same period.

Many homeowners with low mortgage rates below 4% are reluctant to sell and lose their cheap financing. This “rate lock-in effect” limits the number of homes for sale. Although inventory has increased recently, it still remains below pre-pandemic levels in many areas, keeping prices elevated.

In some regions, especially in the South and West, home price growth is slowing or even reversing. Yet, median list prices nationally remain near record highs, putting many buyers out of reach.

A family earning the median U.S. income of about $80,000 could afford a home priced around $543,000 with a 3% mortgage rate. But at today’s 7% rates, their buying power drops to about $356,000, below the median home price. This gap forces many to rent instead.

Renting has become far more attractive compared to buying. Historically, owning a starter home cost about $233 more per month than renting a similar home. Now, that premium exceeds $1,000 monthly. For ownership costs to return to normal, mortgage rates would need to fall to about 3.75%.

Federal Reserve Chairman Jay Powell acknowledged these challenges, emphasizing the need for price stability and a strong labor market to support the housing sector.

Related topics: