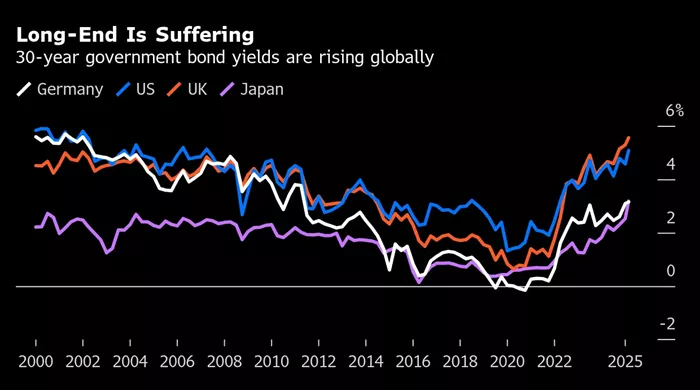

The yield on the 30-year U.S. Treasury bond fell slightly from a 19-month high, easing by 3.7 basis points to 5.0521 percent. The 10-year Treasury note yield also declined, settling at 4 percent.

This pullback comes amid ongoing concerns about the U.S. fiscal outlook and sustained demand for government debt.

Bond prices had dropped earlier due to a selloff, which attracted some buyers and caused yields— which move inversely to prices—to decrease.

The recent spike in yields was driven by worries over the nation’s growing debt and the approval of President Donald Trump’s tax bill by the House of Representatives, which narrowly passed by a single vote. The bill increases military and border enforcement spending and introduces new tax breaks on tips and auto loans.

The U.S. dollar strengthened following the tax bill’s passage, reflecting investor reactions to the changing fiscal landscape. Moody’s credit rating agency downgraded the U.S. debt rating last week, removing the country’s triple-A status and adding to market unease about fiscal health.

On Wall Street, stocks ended the day mostly flat to slightly higher. Technology stocks acted as a market support, with Alphabet shares rising 1.4% and Nvidia shares up 0.8%.

The S&P 500 dipped marginally by 0.04% to 5,842.01, the Dow Jones Industrial Average fell slightly by 1.35 points to 41,859.09, while the Nasdaq Composite gained 0.02% to 18,925.74.

Overall, the bond market remains sensitive to fiscal policy developments and debt concerns, which continue to influence yields and investor behavior.

The recent tax and spending bill, combined with the credit downgrade, has intensified worries about the U.S. government’s borrowing costs and fiscal trajectory.

Related topics: