Quantum computing stocks are gaining strong interest on Wall Street, even more than AI stocks. While AI is still developing, quantum computing could grow quickly if its technology becomes widely used. This is especially true for pure-play startups.

One standout in May was Rigetti Computing (RGTI), which rose over 30% during the month and even reached a 50% gain at one point. This shows strong investor interest, but is now a good time to buy?

Despite its May gains, Rigetti’s stock remains about 40% below its peak in early January. The hype for quantum stocks was highest at the start of the year, so this drop is understandable.

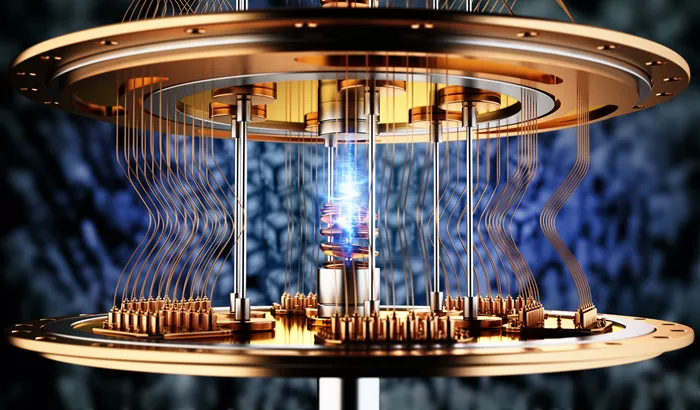

Rigetti offers a full-stack quantum computing solution, meaning it provides a complete system ready for customers. It competes with other startups and giants like Microsoft and Alphabet. The main challenge for all is reducing errors in quantum computing.

Unlike traditional computers that use bits (0 or 1), quantum computers use qubits. Qubits can be both 0 and 1 at the same time, which helps with complex tasks but also causes errors. Rigetti has developed chip designs to cut errors and currently achieves about 99% accuracy, similar to its competitors. It plans to launch a 36-qubit system in 2025, aiming for real-world applications, though widespread use is still years away.

Rigetti estimates the quantum computing market will be $1 billion to $2 billion by 2030, mainly from public companies and government labs. After 2030, demand could jump to $15 billion to $30 billion by 2040. This long timeline raises the question: is it too early to invest?

Rigetti trades at a $3.5 billion market value but only has about $9.2 million in contracts. It is not profitable and recently planned to sell up to $350 million in new shares to fund research. This share sale dilutes current investors and may happen again.

If Rigetti loses the race to develop viable quantum computers, its stock could lose all value. This risk is common among quantum startups. Many investors prefer larger companies with established businesses as a safer bet.

Rigetti is a high-risk, high-reward stock. If you want to invest, consider a small position to limit potential losses. The stock could grow significantly if the company succeeds, but results will take years to confirm.

Currently, Rigetti is not among the top stock picks from leading analysts, who recommend other stocks with stronger potential returns.

Read more: