Mitsuhiro Furusawa, Japan’s former top foreign exchange diplomat, said on Friday that the yen is likely to rise to around 135-140 against the U.S. dollar by the end of this year.

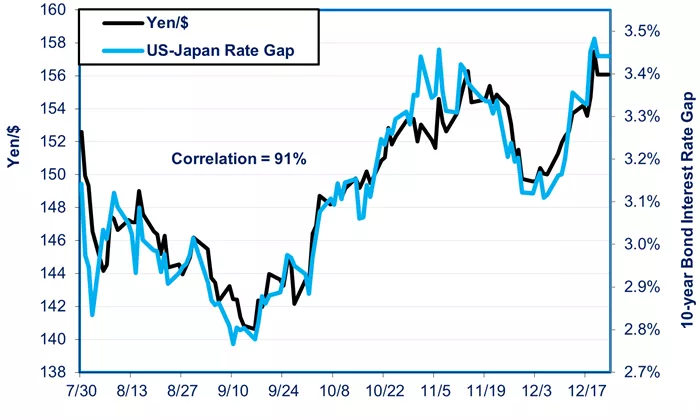

He attributed this mainly to a narrowing interest rate gap between the U.S. and Japan, rather than any deliberate effort by the Trump administration to weaken the dollar.

There has been speculation that President Donald Trump might pressure Japan to devalue the yen to help U.S. exports.

However, Furusawa, who also served as deputy managing director of the International Monetary Fund until 2021, said it is unclear if the U.S. is pursuing a weak-dollar policy. He noted that it is difficult for policymakers to intentionally weaken the dollar and that Washington is focusing more on tariffs as a negotiation tool than on currency manipulation.

Still, the U.S. wants to avoid a stronger dollar hurting its exports, while Japan aims to prevent a weaker yen from fueling inflation. Furusawa said this shared interest suggests the yen will gradually appreciate.

He also pointed to diverging monetary policies as a key factor. The Federal Reserve is expected to cut interest rates, while the Bank of Japan (BOJ) may raise rates if inflation keeps improving toward its 2% target. BOJ Governor Kazuo Ueda has indicated rate hikes will continue if economic conditions allow, though a pause may occur until the impact of U.S. tariffs becomes clearer.

Furusawa added that a broad trade agreement between Japan and the U.S., possibly reached at the upcoming G7 summit, could reduce uncertainty. Rising real wages and easing food inflation would support consumption, potentially prompting the BOJ to hike rates again in the second half of the year.

Currently, the yen trades around 143.90 to the dollar in Asia. Furusawa said the BOJ might eventually raise its short-term policy rate target from 0.5% to above 1%, though success is uncertain.

Japan is also negotiating with the U.S. on automobile tariffs, aiming for a deal by the G7 summit in mid-June. Last month, Finance Minister Katsunobu Kato suggested Japan could use its large holdings of U.S. Treasuries as leverage in talks, but later clarified there are no plans to sell them.

Furusawa said such statements are typical negotiation tactics but warned that threatening to sell U.S. Treasuries could backfire and harm trade talks.