Scalping is a trading strategy that involves making numerous small trades throughout the day, often holding positions for just seconds or minutes. This approach aims to profit from minor price fluctuations. Scalpers, as they are called, target small profits from each trade, but the volume of trades they execute can accumulate substantial gains. While scalping can be highly profitable, it also requires great skill, discipline, and a deep understanding of the markets.

In this article, we will delve into the world of scalping, examining what it is, how it works, the benefits, the risks, and whether it can be a viable trading strategy for both beginner and advanced traders. We will also explore the necessary tools and techniques needed to execute scalping effectively.

What Is Scalping?

Scalping is a short-term trading strategy where traders seek to make quick profits from small price movements. Unlike long-term investing or swing trading, which hold positions for hours, days, or even weeks, scalping involves executing many trades within a single day, sometimes within a few seconds or minutes. Scalpers typically aim to profit from price movements of a few pips or cents per trade.

The primary goal of scalping is to accumulate small profits from these frequent trades. While each individual profit may seem small, the sheer volume of trades a scalper makes can add up to a substantial amount over time. Scalping requires a keen understanding of the market, quick decision-making, and the ability to react instantly to price changes.

How Does Scalping Work?

Scalping works by capitalizing on very small price changes in liquid markets, such as stocks, forex, or cryptocurrencies. Traders using this strategy often focus on liquid markets with tight spreads, allowing them to enter and exit positions quickly and efficiently.

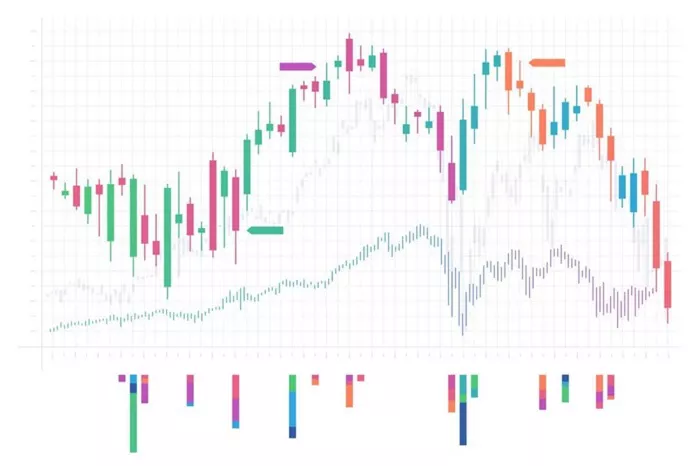

The scalper usually sets up their strategy by analyzing charts in real-time. They might use technical indicators like moving averages, stochastic oscillators, or Relative Strength Index (RSI) to identify the most opportune moments to enter and exit trades. Scalpers also use high-frequency trading tools or automated trading systems to speed up execution.

Scalping requires quick thinking. The trader must be able to enter a position at the right time and exit as soon as the desired small profit has been achieved. It is essential for a scalper to have a tight control over emotions and to avoid the temptation to hold onto a position for too long.

Types of Scalping

Scalping can be performed in different ways, and each trader may employ a different technique. The following are some common types of scalping strategies:

1. Time-Based Scalping

In time-based scalping, traders hold positions for a very brief period, ranging from a few seconds to a few minutes. The focus is on entering and exiting trades quickly, without waiting for significant price changes. These trades are often executed based on the time a trader spends analyzing the charts, rather than waiting for major price fluctuations.

2. Volume-Based Scalping

Volume-based scalping relies on the volume of a particular asset in the market. Traders will enter a position based on significant trading volume and will look for quick profits from the price fluctuations caused by this increased activity. This type of scalping often focuses on the use of order flow and market depth to predict future price movements.

3. Range Scalping

Range scalping is a strategy where traders look for price ranges or periods of consolidation in the market. This approach works best in non-trending markets where prices move within a defined range. Scalpers will typically buy at the lower end of the range and sell at the upper end, repeatedly taking profits from small price moves within the established range.

The Pros of Scalping as a Trading Strategy

Scalping can offer a variety of benefits, especially for active traders who thrive on short-term price movements. Below are some of the key advantages:

1. High Frequency of Trades

One of the most significant benefits of scalping is the high frequency of trades. Scalpers make many trades per day, which allows them to potentially profit from multiple small moves in the market. For traders who enjoy frequent action, this type of strategy can be highly appealing.

2. Limited Market Exposure

Unlike long-term traders who are exposed to the market for hours or days, scalpers are in and out of trades very quickly. This limits their exposure to market risks, as they are not holding positions overnight. This can be particularly beneficial in volatile markets where unexpected events can cause large price swings.

3. Potential for Consistent Profits

While each trade yields only small profits, the high volume of trades can lead to a consistent profit stream. This can make scalping appealing to those who are looking for a steady, incremental growth in their trading account.

4. Low Risk of Major Losses

Since scalpers focus on small price changes and typically close positions quickly, the risk of experiencing significant losses is lower compared to other trading strategies. The quick exit from positions ensures that any minor losses are minimized and do not accumulate into larger setbacks.

The Cons of Scalping as a Trading Strategy

While scalping can offer many benefits, it also comes with significant challenges. It is not suitable for everyone, and traders must be aware of the potential downsides before committing to this strategy.

1. Requires a High Level of Skill

Scalping is not a strategy for beginner traders. It requires a high level of skill and experience to be successful. Traders must be able to analyze the market quickly, make rapid decisions, and execute trades flawlessly. Without these skills, the risk of losses is significantly higher.

2. High Transaction Costs

Due to the high frequency of trades involved in scalping, transaction costs can accumulate quickly. Many brokers charge commissions or spread costs on each trade, and these costs can erode the profits from frequent trades. Scalpers need to ensure that the platform they use offers low fees to remain profitable.

3. Time-Consuming

Scalping requires intense focus and attention to detail. Traders must monitor the market constantly and act quickly. This can be time-consuming, especially for those who are balancing trading with other commitments. The time commitment may make it difficult for traders with busy schedules to successfully implement a scalping strategy.

4. High Stress and Mental Fatigue

The speed of scalping can be mentally exhausting. The need for quick decision-making, coupled with the stress of monitoring many trades in a short period, can lead to mental fatigue. This high stress can impair judgment and result in mistakes, especially for traders who are not adequately prepared for the demands of scalping.

Can Scalping Be a Viable Trading Strategy for You?

Scalping can be an effective trading strategy for certain traders, but it is not suitable for everyone. It is important to assess your own trading style, risk tolerance, and goals before deciding whether scalping is right for you.

Assessing Your Skill Level

If you are a beginner trader, scalping may not be the best strategy to start with. Scalping requires advanced knowledge of the markets, technical analysis, and quick decision-making. Before attempting scalping, it is important to first build a foundation of trading knowledge through other strategies and to practice with demo accounts.

Understanding Your Risk Tolerance

Scalping is often considered a low-risk strategy due to its short time horizon, but it still carries the risk of losses. If you have a low tolerance for risk or if you prefer more relaxed trading styles, scalping may not be the best option for you.

Your Time Commitment

Scalping requires constant monitoring of the markets. If you cannot dedicate a significant amount of time to trading throughout the day, then this strategy might not be practical for your lifestyle. Make sure you have the time and energy needed to manage multiple trades effectively.

Choosing the Right Broker and Platform

To successfully implement a scalping strategy, you need to use a trading platform that is equipped with the necessary tools, such as real-time data, low latency, fast order execution, and low transaction fees. Ensure that the broker you choose supports scalping and offers the features you need to execute your trades smoothly.

Conclusion

Scalping is a high-speed, short-term trading strategy designed to profit from small price fluctuations in the market. While it can be a viable strategy for some traders, it requires a high level of skill, discipline, and a time commitment. Scalping is best suited for active traders who enjoy frequent trades, have the ability to make quick decisions, and can handle the mental stress associated with this strategy.

For those who are interested in scalping, it is essential to choose a trading platform that provides fast execution, low fees, and excellent charting tools. Scalping may not be the best strategy for beginners or traders with a low risk tolerance, but for experienced traders with the right mindset and tools, it can be a profitable and rewarding trading approach.

Related topics:

What Are the Golden Rules for Scalping?

Scalping vs Swing Trading: Which is More Profitable?