Broadcom and Lam Research have seen strong gains in their share prices over the past month. Both companies serve markets that benefit greatly from the growth of artificial intelligence (AI), positioning them for continued healthy growth. Their stocks are also attractively valued, making them good choices for investors interested in AI stocks.

Broadcom: Leading Custom AI Chipmaker

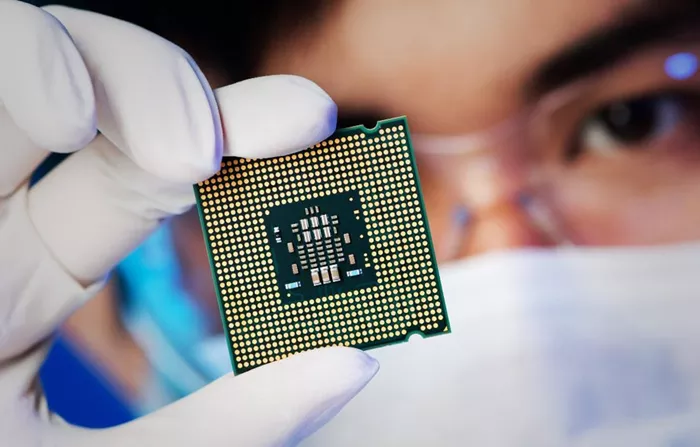

Broadcom (NASDAQ: AVGO) specializes in application-specific integrated circuits (ASICs) and networking chips used in data centers. Demand for these chips has surged due to AI’s expansion. Major cloud companies use Broadcom’s custom AI processors to reduce AI training costs and lessen dependence on Nvidia’s GPUs.

ASICs are designed for specific AI tasks, offering higher computing power with lower energy use compared to general GPUs. This makes them ideal for large-scale data centers, fueling Broadcom’s AI business growth.

Currently, three hyperscale cloud customers deploy Broadcom’s custom AI chips and are working with the company to develop next-generation processors. Broadcom estimates this market alone could be worth $60 billion to $90 billion by fiscal 2027. In the first quarter of fiscal 2025, Broadcom’s AI revenue rose 77% year-over-year to $4.1 billion, suggesting an annual run rate exceeding $16 billion.

Additionally, Broadcom is developing chips for four more hyperscalers, potentially expanding its AI market opportunity beyond current projections. This could lead to stronger revenue growth than analysts expect. The stock trades at a price/earnings-to-growth (PEG) ratio of 0.64, indicating it is undervalued relative to its growth potential. Broadcom’s shares gained 26% in the past month, making it a compelling buy.

Lam Research: Benefiting from AI Chip Manufacturing Growth

Lam Research (NASDAQ: LRCX) produces equipment used by chipmakers to manufacture semiconductors for smartphones, cars, computers, and data centers. The rising demand for AI chips is driving growth in semiconductor equipment spending, which could reach $121 billion in 2025 and $139 billion in 2026.

Key industry players like Taiwan Semiconductor Manufacturing Company (TSMC) plan to build multiple new chip plants, while memory maker Micron Technology expects to invest $50 billion in U.S. facilities by 2030. This expansion supports Lam Research’s strong revenue and earnings growth.

Analysts forecast Lam’s sales to rise 22% to $18.2 billion this fiscal year, with earnings up 32%. Management aims for $25 billion to $28 billion in revenue by 2028, a roughly 50% increase over three years. If Lam maintains its current price-to-sales ratio, its market value could grow by about 65% in that period. The stock currently trades at a forward price-to-earnings ratio of 21.17, lower than the sector average of 25.72, suggesting it is attractively priced given its growth prospects.

Summary

Both Broadcom and Lam Research are well-positioned to benefit from the AI boom. Broadcom’s custom AI chips and Lam Research’s semiconductor manufacturing equipment are critical to AI’s expansion. Their strong recent gains, healthy growth outlooks, and reasonable valuations make them excellent AI stock picks for investors.

Read more: