Stocks fell as investors grew more worried about the chance of the US joining the conflict between Israel and Iran. Federal Reserve Chair Jerome Powell also warned that inflation could stay high for some time.

Europe’s Stoxx 600 index dropped 0.6%, heading for its third straight day of losses. Asian shares fell over 1%, and US stock futures declined. The US dollar strengthened against most major currencies. US stock and Treasury markets were closed for the Juneteenth holiday.

Concerns rose after Bloomberg reported that senior US officials are preparing for a possible strike on Iran soon. Markets were already tense after the Federal Reserve lowered its growth forecast for this year and predicted higher inflation. Tariffs are adding to the uncertainty and making it harder for the Fed to ease monetary policy.

Gareth Nicholson from Nomura said investors are cautious now. They are looking for assets less affected by interest rates or political moves. But he added that few assets are truly safe in this environment.

Former President Trump has publicly considered ordering a strike on Iran, which has been at war with Israel for nearly a week. He said he prefers to make decisions at the last moment because the situation is changing quickly.

Anna Rosenberg from Amundi Investment Institute said the chance of US involvement is high. She explained that the US wants to stop Iran from developing nuclear weapons but warned that any action would have serious consequences.

In Europe, the Swiss National Bank cut its interest rate to zero to stop the Swiss franc from rising too much. The Bank of England is expected to keep rates steady at 4.25% as it balances inflation, rising oil prices, and a slowing economy.

Oil prices moved sharply due to Middle East tensions. Brent crude rose above $77 a barrel, and West Texas Intermediate hovered near $76. Manish Bhargava, CEO of Straits Investment, said a US strike on Iran would likely cause oil prices to spike. This would worsen global inflation and make it harder for central banks to cut rates.

Japanese government bond yields fell after a strong auction and reports that the finance ministry may reduce issuance of long-term bonds.

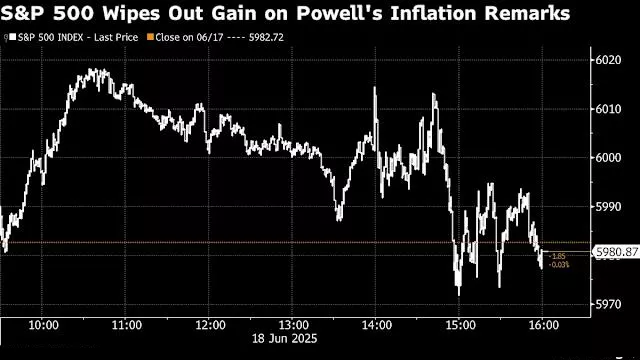

On Wednesday, the Federal Reserve kept its key interest rate unchanged. Powell said tariffs are likely to increase prices and inflation could last longer. While the Fed still expects two rate cuts in 2025, some officials lowered their projections.

Haris Khurshid from Karobaar Capital said the Fed is cautious. Growth is slowing, inflation remains, and geopolitical risks are rising, making it a tough situation.

Market highlights include:

- Stoxx Europe 600 down 0.7%

- S&P 500 futures down 0.5%

- Nasdaq 100 futures down 0.6%

- Dow Jones futures down 0.4%

- MSCI Asia Pacific down 1.3%

- MSCI Emerging Markets down 1.4%

- Bloomberg Dollar Spot Index up 0.1%

- Euro down 0.1% to $1.1468

- Japanese yen down 0.2% to 145.35 per dollar

- Bitcoin steady near $104,758

- Ether down 0.2% to $2,523

- 10-year US Treasury yield steady at 4.39%

- Brent crude up 0.9% to $77.40 a barrel

- Spot gold down 0.1% to $3,365 an ounce

Related topics: